- Who We Serve

- Faith Organizations

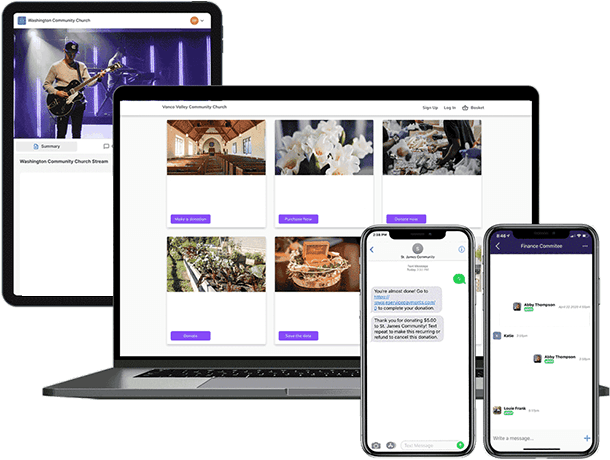

Online Giving for Churches

The Premier Church Giving Platform

Elevate church online giving and support your mission through compelling visual storytelling. Our easy-to-use platform, combined with multiple payment options and exceptional customer service, helps generosity soar for the benefit of the kingdom.

Sign Up Demo

Crack the Code of Generosity and Engagement with Six Essential Tools Included in One Suite

Online Giving Pages

Spark inspiration and simplify church donations online through your church's website.

Mobile Church App

Place the power of giving and engagement directly into your congregation's hands.

Event Ticketing

Make online ticketing, registration and event planning simple.

Text-to-Give

Make one-time gifts or recurring donations as simple as texting a friend.

In-Stream Online Giving

Transform the online worship experience with simplified giving.

Credit Card Swipe Reader

Take payments in person with a quick and easy swipe.

11 Reasons Why 25,000 Churches Choose Vanco and Continue to Stick With Us

1. Customer Service

Customer service is a point of emphasis for Vanco, which is why you’ll get…

- Customer support at no extra charge

- 24/7 emergency customer support

- Short hold times—less than 15 seconds

- In-house support team

2. Free Church App

Simplify online giving, manage virtual groups, facilitate public and private online chats, create an online church directory, manage seating capacity and so much more with your own free app!

3. Giving Pages That Tell a Story

Get an online giving page that inspires giving and allows your church to tell its unique story.

4. No Contracts

No need for long-term contracts. Enjoy month-to-month service that doesn't lock you in.

5. Coaching and Onboarding Included

Get onboarding, a complete library of launch materials and customer support at no additional cost!

6. Multiple Donation Options

Get donations through text, online, mobile app and in-person payments through kiosks or credit card readers.

7. Integrations

We integrate with over 60 church management software providers (and counting) to make your donation reconciliation easier.

8. Complete Data Security

Vanco is a PCI Level 1 service provider, which means your data is backed by the highest standard of security in the business.

9. Experience Helping 25,000+ Churches

We’ve been serving churches for over 20 years. In that time, we’ve learned a thing or two about what churches need, and we’ve developed online giving tools that maximize giving and ease the administrative burden.

10. Free Launch Materials Included

Gain access to hundreds of email, bulletin and letter templates, plus guides, brochures, sample flyers and more to help your church reach its online giving goals.

11. Speedy Access to Funds

Benefit from prompt payment transfers — typically within 24 hours for ACH payments and 48 hours for credit card payments.

INTEGRATIONS

We integrate with 60+ church management systems and finance solutions.

Pricing

Vanco offers packages specifically designed to meet your unique needs, no matter your church size or staff. We don't burden you with contracts or cancellation fees; instead, we arm you with the tools you need for growth.

|

Popular

|

|||||

GROW |

THRIVE |

CUSTOM |

|||

|

$0 /month¹ |

$49 /month |

Call for pricing |

|||

|

|

|

|

|||

|

Debit/Credit Card Rate² |

2.90% + $0.45/transaction

|

2.65% + $0.39/transaction

|

Call for Pricing

|

||

|

ACH Processing Rate³ |

1.00% + $0.45/transaction

|

.90% + $0.39/transaction

|

Call for Pricing

|

||

|

Online Giving |

|

|

|

||

|

Mobile |

|

|

|

||

|

Free Event Management |

Free

|

Free

|

Free

|

||

|

Paid Event Management |

Call for pricing

|

Call for pricing

|

Call for pricing

|

||

|

Text-to-give |

$10/month

|

|

Call for Pricing

|

||

|

Streaming |

N/A

|

|

Call for Pricing

|

||

|

Implementation Support |

|

|

|

||

|

60+ ChMS Integrations |

|

|

|

||

|

Giving Launch Materials⁴ |

|

|

|

||

|

24/7 U.S. Based Support |

|

|

|

||

|

Data Security & Compliance⁵ |

|

|

|

||

|

Kiosk App |

|

|

|

||

|

Kiosk Hardware |

N/A

|

One-time hardware cost, varies by device

|

One-time hardware cost, varies by device

|

||

|

Mobile Card Reader |

One-time hardware cost, varies by device

|

One-time hardware cost, varies by device

|

One-time hardware cost, varies by device

|

||

|

|

GROW

$0

/month¹

THRIVE

$49

/month

CUSTOM

Call for pricing

1 A monthly fee of $10 will be charged if organizations fail to complete their first meeting with a Vanco Giving Specialist within 15 days and have their Vanco online giving page live on their website within 30 days.

2 Applies to all major credit card types except American Express, which is 3.5%. There is a $25 fee per chargeback (consumer refuted payments).

3 ACH returns and credits are charged $5/transaction. ACH transaction fees are applied to transactions and daily batches.

4 We offer editable posters, pew cards, bulletin inserts and more to help you promote your eGiving program.

5 A PCI non-compliance fee of $23.95 will be charged monthly if not compliant with industry data security standards.

Pricing subject to change.

Church Leaders Sing Vanco’s Praises!

See the impact of Vanco's online giving and engagement software on churches like yours!

Pastor Peter

Why Pastor Peter and tens of thousands of other pastors choose Vanco!

Treasurer Dave

Church finance staff and volunteers love Vanco. Watch now to see why!

Recorder Colin

An increase in dues of 75%! Watch the video to get the full story.

CFO Heidi

Hear from our client about the power of storytelling.

Online Giving for Churches FAQ

-

Vanco’s giving and engagement tools allow churches to meet their members where they are. We offer online giving, a free mobile app, event ticketing, livestreaming, text giving and a mobile card reader.

-

With Vanco Online, churches can highlight the great work they do through image-rich giving tiles. Vanco Online helps you tell the story of the impact you're making in your church community and enables your donors to give to the specific causes or missions they are passionate about.

-

Vanco's mobile app has easy giving built into the app and facilitates engagement through event registration plus one-on-one and small group conversations.

-

Each church gets its own 10-digit text number to share with donors. Donors text the amount they choose to give to that number. After texting the amount, first-time givers will be prompted with a link to enter the debit or credit card information they want to use for their donations. After they enter their payment information, donors can simply text their donation amounts moving forward.

-

Vanco Events helps church staff simplify event ticketing and registration for both free and paid events offered at your church. Vanco Events is free for free events.

-

Yes. Our mobile card reader supports payments from all major debit and credit cards.

-

At Vanco, we take protecting the security and privacy of all our clients’ payment information and transactions very seriously. Vanco is PCI Level 1 compliant. As part of our comprehensive security and privacy safeguards, we only collect the pertinent information required to perform payment transactions. That information is stored in Vanco’s secure platform and only used when needed to fulfill requests and services.

-

Yes. Donors can set up recurring donations through our online, streaming and text platforms. Church staff can use email or chat to ask any questions that arise. We're available to help 24/7, and we do not charge for customer support.

-

It sure does. After a donor completes a gift, online, mobile or text, they will receive a receipt via email that they can keep for their records.

-

Yes. Churches can add their own personalized colors and logos to customize their giving pages. They can also choose to either add a link to an existing webpage on their website or embed their giving page in one of their pages.

-

Yes. Churches can add users to Vanco's reporting capabilities so they can access a variety of reports. The platform’s donor management and financial reporting includes donation records by fund, member, payment type and more.

-

Yes. Churches can enable an offset fee that members can choose to add to their donations. The offset fee adds an additional percentage to the donor's gift, which they get credit for on their year-end summary of giving contributions. The church gets an additional percentage to help offset the giving fees.

-

Churches can reach out to Vanco by phone, email or chat to ask any questions that arise. We're available to help 24/7, and we do not charge for customer support.

Data-Driven Church Giving: Discover the Insights Every Church Leader Must Know

We analyzed the giving habits of 1,000 churchgoers across denominations. Uncover surprising trends that ignite generosity and gain insights for increased donations.

Additional Resources

Sorry!

No items currently match your filtering criteria.

.jpg?width=450&height=250&name=giving-data-resource_thumbnail%20(1).jpg)