A strong school audit checklist ensures your district is fully prepared for a thorough financial review. It should cover all critical areas—general accounting, compliance, performance and investigative audits—while supporting pre-audit preparation, in-process review and post-audit actions.

Below, you’ll find a detailed K–12 school audit checklist along with expert guidance from a seasoned school finance professional. In addition to the downloadable resources, you’ll get tips, insights and tools to help make your next audit as smooth and stress-free as possible.

Table of Contents

- Why School Audits Matter

- The Key Four Components of a Comprehensive Annual Financial Report (CAFR)

- What Should Be in a K–12 School Audit Checklist?

- School Audit Checklist - Downloadable Version Included!

- Common Audit Gaps Schools Overlook

- A Few Bonus Tips for Your School Audit

- Streamline Your School Budget Preparation with a Free eBook!

Why School Audits Matter

A school audit is a comprehensive review of a school's financial records, operations, and compliance with relevant regulations. It serves the following purposes:

- Financial Accountability: Ensuring the school is using public funds responsibly and effectively

- Compliance with relevant laws, policies, and regulations

- Efficiency and Effectiveness: Identifies areas of improvement, ensuring resources are used effectively

- Stakeholder Assurance: Reports provide insights regarding school operations to students, parents, and faculty, promoting transparency

- Safety Checklist for Schools: Ensures the school is safe for students and identifies possible improvements. For example, Campus Safety Magazine reveals the results of audits on Texas K-12, indicating that 95.6% of inspectors could not get unauthorized access to the campus, a statistic that may not have been possible if audits weren't required.

Various education audit types, including performance, financial, and school policy compliance, can be conducted. These audits can be performed separately or concurrently, as part of a larger financial audit process for schools.

After the school recordkeeping audit is complete, schools receive a Comprehensive Annual Financial Report (CAFR). The goal is to obtain a CAFR with an "unqualified opinion" and no audit findings. Schools that achieve this goal will foster confidence among stakeholders in financial management, potentially reducing the cost of financing various projects and extending the school's budget.

The Four Components of a Comprehensive Annual Financial Report (CAFR)

The CAFR is comprised of 4 sections as follows:

- The Introductory Section: Provides general information about the school district, including its structure, services, and environment. It includes:

- A letter of transmittal from the school district, summarizing its accomplishments, financial condition, initiatives, and long-term plans.

- Organizational charts.

- A list of key officials.

- Other information that provides insight into district operations.

- The Financial Section: Indicates the health of the school's finances. It includes:

- The Independent Auditor's Report reveals the financial statements' fairness.

- Management's Discussion and Analysis (MD&A): This section explains the school's financial performance and condition.

- Basic Financial Statements, such as government-wide and fund financial statements.

- Notes that provide more details on the financial information in the report.

- The Statistical Section: Provides information on overall financial trends and economic conditions. It includes:

- Financial Trends Information shows how the school's financial health has changed over time.

- Revenue and Debt Capacity Information provides insights into how well the school generates revenue and manages debt.

- Operating Information shows the number of employees, capital assets, and similar data.

- The Single Audit Section: This section is reserved for schools that receive more than $750,000 in federal aid and contains opinions on the school's internal controls and compliance with state and federal grant regulations.

The Introductory and Statistical Sections of the CAFR are not major concerns as they contain unaudited information related to revenue, debt, demographics, and other economic operations. The findings in the financial section and single audit section, if applicable, are potentially more concerning.

The Audit Process

This section provides insight into the audit process so schools can prepare their annual school audit checklist accordingly:

- The auditor will reach out to the school to schedule their audit. They will also include a list of items you should have ready for the annual school review.

- The auditing professional will arrive at the school to review the provided information. They may also interview staff members.

- The information collected will be reviewed and compiled into an audit report. Depending on the extent of the review, the report can take a few days to a few months to prepare.

What Should Be in a K–12 School Audit Checklist?

Use this school audit checklist to prepare for your upcoming audit confidently. It covers every key area auditors will review, helping your team stay organized, accurate, and compliant.

Key Audit Areas Covered

- General Accounting – Budgets, bank records, and vendor reports

- Payroll – Contracts, pay records, and tax filings

- Student Activities – Club accounts and cash controls

- Food Service – Inventory, reimbursements, and compliance docs

- Transportation – Vendor contracts

- Enrollment & Reporting – State-required data and backup

- Special Funds – Grants, reimbursements, and final reports

- Fixed Assets & Capital Projects – Equipment, depreciation, and planning

- Long-Term Debt – Bonds, leases, and amortization

- Enterprise Funds & Statistics – Tuition, trends, and financial outlook

Let’s walk through the school audit checklist to ensure nothing gets missed.

The 105-Point School Audit Checklist

Access our free, downloadable version of the checklist for school audit, which is also included in the following document.

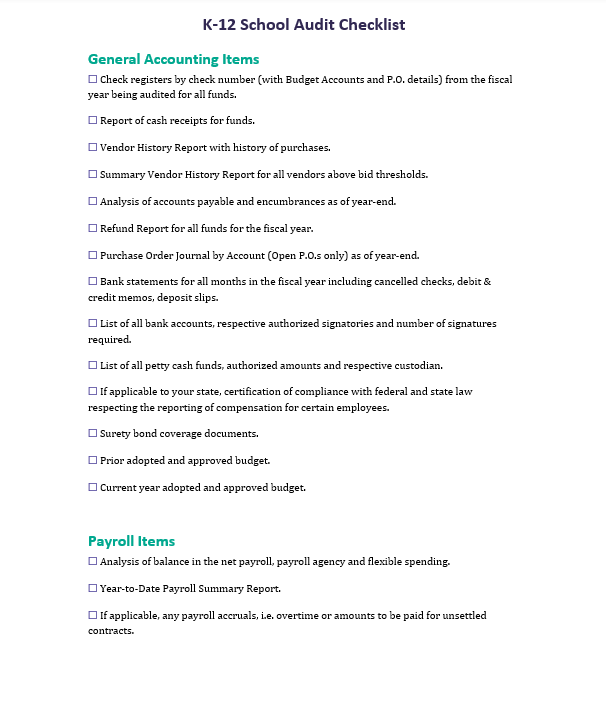

General Accounting Items

- Check registers by check number (with Budget Accounts and P.O. details) for all funds from the fiscal year being audited.

- Report of cash receipts for funds.

- Vendor History Report with history of purchases.

- Summary Vendor History Report for all vendors above bid thresholds.

- Analysis of accounts payable and encumbrances as of year-end.

- Refund Report for all funds for the fiscal year.

- Purchase Order Journal by Account (Open P.O.s only) as of year-end.

- Bank statements for all months in the fiscal year, including cancelled checks, debit & credit memos and deposit slips.

- List of all bank accounts, respective authorized signatories and number of signatures required.

- List of all petty cash funds, authorized amounts and respective custodians.

- If applicable to your state, certification of compliance with federal and state law respecting the reporting of compensation for certain employees.

- Surety bond coverage documents.

- Prior adopted and approved budget.

- Current year adopted and approved budget.

Payroll Items

- Analysis of balance in the net payroll, payroll agency and flexible spending.

- Year-to-Date Payroll Summary Report.

- If applicable, any payroll accruals, i.e., overtime or amounts to be paid for unsettled contracts.

- All quarters of Federal 941 filings.

- Copies of the contracts for key personnel, i.e., superintendent and school business officials, and bargaining units.

- Employee Attendance Reports.

- Service Audit from the payroll company.

Student Activities Items

- Student Activity bank statements and respective bank reconciliations for fiscal year, including cancelled checks, debit & credit memos, deposit slips.

- Student Activity vouchers and supporting invoices.

- Student Activity cashbooks or cash ledgers for the various schools.

- Analysis of each student activities account by club or activities as of year-end.

- All School Petty Cash Analysis.

- Student Activity Accounts Payable Analysis (if any).

- Scholarship account activity and reconciliations (if any).

Transportation Items

- Access to all transportation contracts for fiscal year.

Food Service Items

- Food service vendor records, including separate inventory listings for donated commodities and regular inventory, monthly operating statements, and payroll registers (if food service is outsourced), are crucial for efficient management; learn more about streamlining these processes with our School Mealtime Payment System.

- Monthly food service reimbursement vouchers from federal and state governments.

- Food Service Free & Reduced Lunch Applications.

- Food Service Free & Reduced Lunch Application Verification Summary and supporting documentation.

- List of any new equipment over $2,000 purchased in the Food Service Fund.

- Analysis of fixed assets as of year-end.

- Copy of the agreement to participate in the National School Lunch Program.

- List of food service accounts payable and receivable at year-end.

- Copy of food service contract and SOC1 Report (if outsourced).

- Copy of food service vendor’s SAS 70 Audit Report (if outsourced).

- Fiscal Year Meal Price List.

- Analysis of prior year food service accounts receivable, showing what was collected and what was cancelled.

- Food Service Transfer Journal Entries.

Official Enrollment Report Items

- State required enrollment and transportation reports and supporting documentation, if applicable.

General Fund Items

- Accounting software reports of expenditures by account, with check and purchase order details for the fiscal year.

- Accounting software reports of revenues by account for fiscal year.

- Trial balances or balance sheet for all funds for fiscal year.

- Accounting Software Receipts Report for all funds for fiscal year.

- Board Secretary’s & Treasurer’s Reports for all funds for fiscal year.

- General Journal Reports for all funds for fiscal year.

- General Ledger Reports for all funds for fiscal year.

- Purchase Order Journal for all funds as of year-end.

- Purchase Order Journal by Account for open purchase orders as of year-end for all funds.

- Analysis of accounts payable as of year-end for all funds.

- Check registers by check number with details from the beginning of the next fiscal year until the date of the audit.

- General Ledger Reports for all funds from beginning of next fiscal year until the date of the audit.

- Monthly bank reconciliations for all accounts.

- Outstanding check lists.

- Bank Statements for months for all accounts from beginning of next fiscal year until the date of the audit.

- End-of-Year Transfer Worksheet.

- Completed fraud risk interview questionnaires.

- Access to records of travel reimbursement, including travel request forms and summary of attendance reports.

- Analysis of any employees and board members approved for regular business travel.

- Report and budget details of all school taxes paid.

- Analysis of miscellaneous revenue.

- Analysis of accounts receivable.

Special Revenue Fund Items

- All grant award notices and approved budgets.

- Copies of required Financial Special Project Completion Reports filed in connection with state, federal or special projects (such as NCLB, IDEA), etc.

- Copies of prior year Special Project Completion Reports and copies of warrants remitting unexpended balances that were not approved for carryover to the grantor agency.

- Copies of grant final expenditure reports.

- Grant reimbursement requests submitted, along with supporting documentation.

- Copies of vouchers for remitting unexpended balances that were not approved for carryover to the grantor agency.

- Pension/OPEB reimbursement voucher and supporting worksheets if applicable.

- Employee certification or timesheet support for employees charged to federal grants.

Capital Projects Fund Items

- Copy of latest Long-Range Facilities Plan if applicable.

- Accrued Compensated Absences Analysis, including detail by employee and by function for the fiscal year.

- Flexible Spending “Register” Report for fiscal year.

- Unemployment Account “Register” Report for fiscal year.

- Payroll “General Ledger” for fiscal year.

- Payroll “Deposit Detail” for fiscal year.

- Payroll “Balance Sheet” at year end.

Fixed Assets

- Summary & detail listing of fixed assets as of year-end by function and category.

- Listing of additions by function and by category, in fiscal year.

- Listing of deletions by function and by category, in fiscal year.

- Listing of depreciation expense by function and by category.

Other Post-Employment Benefits Items

- Allocation of employee benefits by function for GASB #34.

- Allocation of on-behalf pension/OPEB by function.

- Allocation of reimbursed pension/OPEB FICA by function.

- Listing of fiscal year retirees and amounts paid out or due by function.

Long Term Debt Items

- Copies of amortization schedules for any serial bonds issued in fiscal year.

- Lease agreements (if any), including amortization schedules with breakdown between principal and interest and the interest rate.

- Bond issuances or refinancing’s (if any), including amortization schedules with breakdown between principal and interest and the interest rate(s).

Enterprise Funds Items

- Enterprise funds analysis of cash or cash ledgers.

- Enterprise fund bank reconciliation at year-end.

- Enterprise funds analysis of tuition received for fiscal year.

- Enterprise funds student enrollment for each program provided.

- List of financial highlights, factors affecting the district's future, cost savings implemented during the year, and budget amendments, if any, to be included in the Management Discussion and Analysis.

Additional Data Items Needed for the Statistical Section

- Local official property tax information relevant to the revenue base of the district.

- Information about the payers or remitters, as appropriate, for the school district’s largest own-source revenue for the current fiscal year and the nine fiscal years prior.

- Regional demographic and economic indicators, such as population, per capita personal income, unemployment rates.

- Information about the principal employers in the school district’s jurisdiction, i.e., the 10 largest employers presented, unless fewer are required to reach 50 percent of total employment, for the current fiscal year and the nine fiscal years prior.

- Operating information for the school district, including number of the school district’s employees by function.

- Other statistical schedules for GASB #44, including outstanding debt of governmental activities and business-type activities, as well as the total outstanding debt for the district.

Additional Data Items Needed for the Introductory Section

- Organizational chart.

- Roster of officials with expiration terms and employment.

- Listing of consultants and advisors.

Common Audit Gaps Schools Overlook

Many schools scramble when an audit is upon them. They look for and review the necessary documentation, ensuring it's present and accurate. However, preparing a school accounting audit checklist is a year-round process that should be considered at all times.

Here are some areas to pay close attention to, as they are often overlooked. We will also provide a review of the school audit checklist to ensure you are prepared.

Examples of overlooked audit areas

Internal Controls Checklist

- Missing Documentation: Schools may be missing financial transactions, asset management, or regulatory compliance documents.

- Lack of Adherence to Policies: The audit may identify errors and fund misuse that occur when schools don't adhere to purchase and approval policies and disbursement procedures.

- Incomplete or Untimely Records: School records should be complete and filled out promptly. Student enrollment, financial aid disbursement, and asset management records are especially crucial.

- Inadequate Monitoring: Audits can uncover instances when policies and procedures are not followed and issues aren't addressed promptly.

School Compliance Checklist

- Special Education: Schools must be compliant with special education regulations and the proper execution of recommendations.

- Financial Aid: Issues can arise with student learn disbursement location and Title IV funds for higher education.

- Consumer Information: Schools must provide parents and students with the insights they need to make informed decisions on educational matters. Unfortunately, not every school meets this requirement.

- Safety and Security: Critical issues often overlooked regarding safety and security include reunification planning, behavior threats and adherence to hygienic standards. Your school risk assessment should consider these factors.

Other Areas

- Cybersecurity: Schools must ensure their technology follows standard practices for data privacy.

- Equity: Equity issues occur when schools do not address opportunity gaps and systemic inequalities that impact the learning environment.

Quick bullet list of “double-check” items

Schools should follow financial, compliance, operational and safety regulations year-round. However, there are certain things that schools can do to ensure they are audit-ready and increase their chance of a positive outcome. They include:

Financial Records and Budget Review

- Review each department's budgets and expenses to ensure records are accurate.

- Ensure accurate reconciliation of bank accounts and financial statements.

- Double-check for reporting errors that may arise in categorization and documentation.

- Confirm that funding sources are correctly identified and documented.

Internal Processes

- Ensure all internal procedures are documented.

- Verify accurate record-keeping with supporting documentation.

- Establish clear communication channels, ensuring staff members understand what will be required during the audit process.

- Prepare a schedule of expenditures and federal awards, such as the grantor agency, pass-through agency, grant identification, and funding period.

Gather all documents in a central location, ensuring you are prepared for your audit.

A Few Bonus Tips for Your School Audit

Ensure each requested item is completed and provided before auditors arrive for a smooth process that causes minimal disruption to district operations. Here are some additional best practices to help you survive your next school audit.

Communicate Frequently and Politely

The annual audit can be a stressful time, but remember, the auditor is just another human doing their job. Don't take anything they question as an attack on your person or shy away from their input.

Additionally, you should keep track of written communications between you and the auditor during the previous fiscal year. For example, you may reach out to your auditor to ask them how to record a transaction. Later, on-site auditors may question the transaction recording during the audit process.

An email thread with the auditor's instructions from earlier in the year verifies your recording process and ensures you can easily address concerns.

Take Your Time During Review

If this is your first K-12 audit, estimating how much time you'll need to review your documents can be difficult. If possible, speak to another official who is familiar with the district's policies and requirements to help you estimate--and then add extra time on top of that. Although the review process is time-consuming, review every page to avoid missing crucial information and mistakes.

Delegate Early and Often

It can be tempting to try and prepare for the audit on your own. Although you may not want to ask your peers for help, taking on this task without assistance can be stressful and reduce your ability to prepare thoroughly and confidently. Ideally, you'll start making a school facility inspection checklist and delegating tasks to fellow staff members right away.

Assigning audit-related tasks to co-workers will make them stakeholders in the process, which means they'll be motivated to provide support and assistance. Recognizing their value ensures you get through the audit process without losing sleep.

In the days before the auditor's on-site visit, coordinate with your Registrar. Set aside an appropriate place for the meeting, confirm that the auditor has received the submitted documents, and give them access to the necessary systems. It's also important to have your notes ready.

While reviewing documents, you may encounter items you believe the auditor will question. As you gain more experience with K-12 audits, you'll likely be second-guessing documents less often. Still, you may want to address issues to ensure a smooth process.

With the right preparation, you'll find that the audit flies by, and they'll only get easier. Come up with a process of preparation, review, and discussion that works for you, and you'll soon have a foolproof system to help you survive every audit in your career.

FAQs About School Audit Checklists.

What is included in a school audit?

Requirements vary depending on the type of audit, but the review may include the following:

- Financial statements

- Internal controls

- Compliance

- Procurement of purchases

- Payroll

- School governance

- Technology

- Safety and security

- Academics and curriculum processes

- Student programs

- Asset management

How often should a school conduct an audit?

Schools are typically audited annually. However, the schedule may vary as follows:

- Large schools with substantial budgets may be audited annually.

- Small schools with less federal funding may be audited less frequently, perhaps every two years.

- Specific regulations may dictate how often schools are audited.

A school may also conduct internal audits regularly to ensure that it is prepared for external audits and that its systems are running smoothly. According to Tability, an internal audit for schools should show no more than 2-5 findings and less than a 5% discrepancy to support a successful external audit.

Who conducts audits in schools?

School audits may be conducted by:

- External Auditors: These are typically independent CPAs or government auditors that the school district hires.

- Government Agencies: Agencies such as the U.S. Department of Education Office of Inspector General (OIG) and the California Department of Education's Audits & Investigations Division conduct school audits, especially for federally funded schools.

- Internal Audits: These are typically conducted by school or school district employees.

Streamline Your School Budget Preparation with a Free eBook!

Creating a school budget isn’t easy. That’s why we researched the best practices and the optimal steps school finance officials should take when creating a budget. Download the eBook to see...

- The six best practices every school and district should follow.

- The eight-step process to creating the perfect school budget.

- The three steps to simplify school payments and recordkeeping.

- And more!

Want support with audit prep and financial management? Call us at 866-940-1352 to see how we can help.

.jpg?width=734&height=251&name=School-Lunch-Kit_blog_CTA_image%20(1).jpg)