Not all states require daycare centers to have liability insurance, but it can reduce expenses when incidents occur and improve the company’s reputation, helping it attract more enrollments. Liability insurance covers injuries and property damage costs, ensuring children are cared for if the worst occurs, and may also cover legal expenses.

Without coverage, daycare administrators are at risk. If something happens to a child or worker at their center, they must cover damages themselves. The center may even close if authorities find out about a lack of insurance. Additionally, families may be reluctant to sign up children for after-school programs that don't have insurance.

An NAEYC survey on Liability Insurance and Early Childhood Education reveals that 88% of educators think liability insurance is essential because it protects their business, 82% say it protects the families they serve, and just 62% say it’s essential because it’s a state requirement.

Table of Contents

- What Is Daycare Liability Insurance?

- Types of Coverage Available

- How Much Does Daycare Liability Insurance Cost?

- How to Choose the Right Insurance Policy

- Legal Requirements and Compliance

- Common Risks Faced by Daycare Centers

- How Vanco Supports Daycare Owners

- FAQs

- Final Thoughts on Daycare Liability Insurance

- 100+ Free Printable Templates to Make Running Your Daycare Easier

Vanco offers several resources to help you effectively run your preschool program, including our Ready-Made Templates & Guides for Efficient Daycare & Preschool Management. Fill out our online form to access your free download.

What Is Daycare Liability Insurance?

Daycare liability insurance protects daycare providers from potential financial losses related to accidents, injuries and property damage. It offers coverage in these areas:

- General Liability: Covers injuries and damage that occurs on the property

- Errors & Omissions: Protects against claims of negligence or mistakes made by your staff, such as a lack of supervision, that may have caused injuries or damage

- Abuse and Molestation: Covers claims for child abuse and molestation

- Commercial Property: Covers damage to your building, equipment and other property

- Business Income: Replaces lost income if you can’t operate due to property damage or other circumstances

- Accident Medical: Covers children’s medical bills if they are injured in your care and if expenses exceed their parents’ insurance

- Umbrella Liability: Offers additional liability beyond the limits of your other insurance policies

- Other Coverages: May include accidental medical payments that cover minor care needs, corporal punishment liability (which covers incidents where a staff member is accused of inappropriately disciplining a child) and field trip liability (which covers incidents outside the facility)

Why Daycare Centers Need Liability Insurance

Daycare centers need liability for these reasons:

- Cover injuries: Children are prone to injuries. If a child is injured at a daycare center without insurance, the organization may face extensive legal and medical bills. Liability insurance ensures these expenses are covered, resulting in a beneficial situation for the organization and the injured child’s family.

- Cover other incidents: Children’s injuries are typical in daycare facilities. However, other incidents, such as property damage, abuse and visitor slips and falls may occur. Daycare liability insurance ensures these expenses are covered.

- Meet legal requirements: Several states require insurance for licensing purposes.

- Reduce expenses: Liability covers various expenses when incidents occur, including medical expenses, property damage and legal fees.

- Increase enrollment: Liability insurance is a characteristic of high-quality child care. Parents prefer working with a daycare center with liability, potentially increasing sign-ups.

Common Misconceptions About Daycare Insurance

Because the internet is a prime information source, there are several misconceptions about daycare insurance. This section addresses common myths and provides the facts.

Myth: Homeowner’s Insurance Covers In-Home Daycare

Unfortunately, this is not true. If you open a daycare center in your home, you must still purchase home daycare liability insurance to cover business-related injuries and damages. Your homeowner’s insurance will not cover these costs.

Myth: Daycare Insurance Automatically Covers All Claims

This statement is also a myth. Policies vary among organizations and may not cover all claims. Find out what yours covers to ensure it applies to high-risk scenarios.

Myth: Liability Insurance Is All I Need

Liability insurance covers many incidents, but it doesn’t cover everything. Other types of insurance, such as property insurance and workers’ comp, may be required by law or are highly recommended.

Myth: If a Parent Signs a Liability Waiver, I Can’t Get Sued

A waiver does not protect a daycare center from lawsuits. Waiver enforcements vary by state, but they rarely prevent a daycare center from getting sued. At best, they may avoid frivolous lawsuits.

Myth: Only Large Daycare Centers Get Sued

Unfortunately, any daycare center can get sued, regardless of size and nature. Don’t assume that being a smaller daycare puts you under the radar. Any operation can face a lawsuit.

Myth: Insurance Is Too Expensive

Insurance can be expensive, but it doesn’t compare to the expenses you will pay if you are sued. Miller & Zois Attorneys at Law gives the example of a lawsuit that amounted to $1,420,000 — too much money to risk.

Types of Coverage Available

Once you begin shopping for insurance, you will learn about the available types to determine which are required or recommended for your organization. Here are some to choose from.

General Liability Insurance

Daycare centers are required by law to purchase general liability insurance. It offers protection against accidents and injuries and financial losses related to:

- Bodily injury: Insurance covers any injury on your property, such as a child or parent falling and injuries in child-to-child incidents. It does not cover employee injuries. These are covered by workers’ comp.

- Property damage: The insurance covers damage to any property you own or rent. For example, it may provide coverage for vandalization or if a worker or client accidentally damages your building.

- Legal fees: Daycare centers are covered for legal fees related to their businesses. For example, if a child falls on your property and the family decides to sue, the insurance will cover part or all your legal costs.

- Personal or advertising injury: Liability insurance covers any losses you may suffer due to slander or copyright infringement. For example, it will cover losses if someone campaigns to damage your professional reputation and you lose clients.

Professional Liability Insurance

Professional liability insurance is typically included in general liability policies. It provides coverage for negligence claims, also known as errors and omissions (E&O insurance). Professional liability insurance protects professionals from claims of negligence or mistakes that lead to business-related incidents.

Why Professional Coverage Is Essential

Here are some scenarios where professional liability insurance may be required.

- Negligence: A negligence claim asserts a professional failed to exhibit the appropriate level of care and skill in their work. For example, a child may fall on the playground because they were in an area they shouldn’t have been in because the staff was not supervising them.

- Errors and omissions: This is a claim that the professional made a mistake or failed to do something they should have done. For example, they may have forgotten to put sunblock on a child, resulting in a dangerous sunburn.

- Inaccurate advice: In this situation, the professional provides incorrect or misleading information, causing clients to harm themselves. For example, they may tell a child it’s okay to eat Play-Doh, so the child eats it and gets sick.

Property Insurance

Although property insurance is not always legally mandated, it is recommended as it provides risk management for daycare centers. It provides reimbursement if the property or equipment is damaged, either purposely or by accident.

Protection for Daycare Facilities and Equipment

Property insurance covers financial losses due to damage and theft. It applies to owned and rented property and equipment.

What Property Damage is Typically Covered

Property damage insurance provides coverage for:

- Dwellings: The physical structure of your facility and any additions and fixtures from fire, wind, hail, accidents and vandalism

- Business personal property: Equipment, furniture, devices, appliances, supplies, etc.

- Exterior fixtures: Fixtures outside your facility, such as fences, outdoor signs and landscaping

- Loss of income: Losses incurred if your business has to close due to property damage

Property damage insurance covers losses related to perils such as fires, storms, explosions, burst pipes, theft and vandalism. It does not cover damages related to earthquakes, floods, losses in transit, burglary, cybercrime and fraud, or damage to vehicles. If you feel these are risks for your business, additional insurance provides risk management for daycare centers.

Workers’ Compensation Insurance

Every state except for Texas requires businesses, including daycare centers, to purchase workers’ comp insurance for at least some employees. It provides coverage for employees injured on the job or who get sick due to work-related causes.

Coverage for Employee Injuries

- Medical expenses: All medical expenses incurred immediately after the accident and ongoing rehab costs

- Lost wages: All wages the employee lost taking time off work to recover

- Disability benefits: Workers’ comp will pay disability benefits if the accident leads to a permanent injury that prevents the employee from working

- Death benefits: If a worker dies due to an injury, workers comp will help with funeral expenses and provide other financial support for the family

- Vocational training: Vocational training may be necessary if the worker’s injuries prevent them from returning to their original position; it helps prepare them for a new job

Legal Requirements for Workers’ Compensation

The legal requirements of workers compensation vary from state to state and may include these features:

- Obtain workers’ comp: Employers must obtain workers’ comp to cover employees who become sick or injured on the job.

- Injury and Illness Prevention Program (IIPP): The company must establish an IIPP, a written policy for injury and illness prevention.

- Reporting system: Companies must establish systems that mandate a reporting window and how the process occurs. They must also provide claim forms employees can fill out in the event of an injury.

- Authorize medical treatment: Employers must authorize medical treatment, typically within a day of receiving a claim form.

Workers must also comply with reporting injuries correctly, completing and returning the claim form within the authorized window, and seeking medical attention to confirm their injury.

Abuse and Molestation Liability Coverage

An abuse and molestation policy will cover costs related to sensitive issues that occur at your facility. It addresses incidents between children and other children and children and staff members.

Importance of Safeguarding Against Sensitive Risks

Daycare liability insurance may cover certain aspects of abuse and molestation incidents, but there is often limited coverage for such allegations. Specialized coverage can provide the daycare business protection you require, such as:

- Financial protection: The insurance can cover legal, medical and reputational costs related to the incident.

- Peace of mind: Daycare owners will know their facilities are covered in worst-case scenarios.

- Protects vulnerable populations: Children are a vulnerable population. The right coverage protects children and your business.

How This Coverage Helps Protect Business

Abuse and molestation coverage comes in different shapes and sizes. For example, some agencies offer coverage for allegations or compensation you are legally required to pay if a minor is abused while in your care. Others provide enhanced early childhood education protection, including physical abuse liability coverage for daycare.

Commercial Auto Insurance

Commercial auto insurance is necessary for daycare centers that require workers to drive company-owned vehicles.

Coverage for Daycare Transportation Services

Many daycares have fleets of buses that take children to and from the center and perhaps transport them on special field trips. Commercial auto insurance covers:

- Bodily injuries incurred in an accident

- Damage that may occur to your vehicle, other vehicles, and property

- Medical care for anyone who was injured in an accident

- No-fault or personal injury protection covers lost wages and medical expenses regardless of who was at fault

- Uninsured/underinsured motorist coverage to cover expenses if you get in an accident with an uninsured or underinsured motorist who cannot cover the full damages

Who Needs Commercial Auto Insurance?

You will need commercial auto insurance if your company uses commercial vehicles. If your workers use their cars at work, you may consider purchasing hired and non-owned auto insurance. This insurance will not cover incidents when workers drive to and from work. Instead, it is for incidents that occur while employees drive for work-related purposes, such as attending meetings or running errands.

How Much Does Daycare Liability Insurance Cost?

Small business liability insurance is an added expense for daycare programs that don’t typically have a lot of funding. So how much does it cost? Prices vary depending on various factors.

Factors Affecting Insurance Premiums

- Type of daycare: Home daycare liability typically offers lower premiums than commercial daycare centers.

- Number of children: The more children enrolled, the more you pay.

- Location: Premiums may be higher in certain areas. Preschool insurance is typically more expensive in urban areas due to potentially higher crime rates.

- Coverage limits: Insurance companies will consider what’s covered and the value of the covered assets when determining premiums.

- Claims history: Organizations with a claims history will pay higher rates.

- Services provided: Daycare centers that offer field trips, sports programs and other activities that pose liability risks in childcare will have higher premiums.

- Staff experience and credentials: Your staff’s experience and credentials can also affect how much you pay. You may pay lower rates if your staff is experienced in caring for and protecting children.

- Abuse and prevention measures: Facilities that go out of their way to train staff in abuse and prevention measures may pay lower premiums.

- Facility condition: A well-maintained facility may result in lower premiums. Additionally, a facility with equipment that may increase liability risks in childcare, such as a trampoline or pool, may face higher premiums.

- Revenue and payroll: Insurance companies assume that a daycare center with higher revenue and payroll has more to lose and may charge higher premiums.

Average Cost Estimates for Small and Large Daycare

Insurance rates vary based on location, the type of daycare, services provided, and other factors. However, the most significant factor may be the size of your daycare.

Statistics show that costs are driven primarily based on size:

- Liability for a home-based childcare center ranges from $495 to $1,480

- Liability for a commercial childcare center ranges from $1,100 to $2,200

You may save money by purchasing a package policy — 2023 statistics reveal these can cost between $1,000 and $3,000 annually.

Other coverages can add to your expenses, for example:

- Commercial auto insurance can add $1,100 to $4,000 to your annual insurance bill depending on the number of vehicles you operate and their driving radius.

- Commercial property insurance is typically between $500 and $1,000 per year, depending on the value of your property and equipment.

- Workers’ comp can cost between $5,000 and $7,000 depending on the number of employees and location.

- Abuse and molestation insurance is typically included in a liability policy but could elevate costs.

- Home daycare riders are add-ons to home insurance that cover home-based daycare operations.

Strategies to Reduce Insurance Costs

Insurance can be costly, but you can reduce costs with several strategies for managing your daycare center and shopping for policies.

Consider using these management techniques:

- Offer staff safety training: Train staff on child safety, including first aid and CPR, to reduce liability risks in childcare.

- Provide a safe environment: Ensure your daycare center is free from hazards, offers supervision and age-appropriate equipment, and is well-maintained. Conduct regular inspections to address maintenance needs.

- Observe health policies: Enforce health policies that reduce the spread of sickness and address medical situations immediately. Ensure that health is part of your daily schedule.

- Set an effective staff-to-child ratio: Ensure you have a strong staff-to-child ratio, typically between 1:10 to 1:15.

- Reinforce abuse prevention: Educate staff to recognize signs of abuse in children.

- Get accredited: Accreditation can reduce insurance costs.

- Conduct building inspections: Inspections will help you address risks that could lead to water and other property damage.

When shopping for daycare policies:

- Consider a business owner’s policy (BOP): A BOP combines general liability and commercial property insurance, potentially lowering costs.

- Determine your deductibles and coverage limits: Evaluate your insurance needs to determine the deductibles and coverage limits that work with your budget.

- Claim deductions at tax time: Commercial daycare centers can claim a deduction of 100% of liability insurance costs at tax time. Talk to your tax expert to ensure you get the appropriate deductions.

- Shop around: Compare quotes to ensure you get the best value for your money.

- Bundle coverage: The best daycare insurance providers offer discounts to daycare centers that purchase multiple policies with their companies.

- Ask about discounts: Insurers may offer discounts based on your company history, business type and other factors. Ask about discounts regularly, as they can become available at any time.

- Maintain coverage: Lapsed childcare liability coverage can add to expenses. Keep your coverage current to avoid additional fees.

- Work with a knowledgeable broker: Work with a broker with experience in daycare center insurance. They will guide you to find the right policies and help you save money.

- Get multiple quotes: Compare quotes to ensure you get the best value for your money.

How to Choose the Right Insurance Policy

Choosing the right policy is a big decision. You must ensure you have the childcare liability coverage you need at the right price. The following sections will guide you through the process.

Key Factors to Consider When Selecting a Policy

- Amount to spend: Business owners should determine the average cost of daycare insurance and decide how much they can afford within that range.

- Risks: Determine common risks at your facility, such as child injuries, property damage, abuse, and neglect. Ensure your policy provides coverage for these risks.

- Business revenue: Experts recommend allocating 1-5% of your revenue to liability insurance; however, high-risk companies may need to spend more.

- State and local regulations: Local laws may mandate specific coverage requirements regarding coverage levels. Some states may require special coverage for abuse and molestation. Learn what your local laws require and ensure your policy meets your needs.

- Deductibles and premiums: High deductibles can lower the cost of premiums, but they result in increased expenses if claims arise. Determine which is best suited to your needs.

- What’s covered: Policies may include different types of coverage, such as:

- Abuse and molestation coverage

- Defense costs to cover legal fees

- Occurrence-based or claims-made

- A claims-made policy will only cover incidents reported within the policy’s time frame unless a tail is purchased.

- An occurrence policy offers lifetime child liability coverage for incidents within the policy period, regardless of when they are reported.

- Exclusions for risks like swimming pools and trampolines

- Home daycares may require a special home daycare endorsement, adding to expenses

- Replacement cost or actual cash value

- Replacement cost is better as it replaces the actual item rather than reimbursing you for losses based on depreciation value.

Be transparent about your needs. It can be tempting to alter specific facts, such as the value of your building or equipment, to qualify for a lower premium, but doing so can lead to more expenses if an incident occurs. Be transparent about your insurance needs to get a package tailored to your company.

Questions to Ask Insurance Providers

Here are some questions to ask your insurance provider to ensure your policy meets your needs:

- Does the insurance cover child-specific risks? These may include accidents, injuries and allegations of abuse and molestation.

- Are there specific coverage options for property damage? This question will help you determine if coverage applies when a child or employee accidentally damages equipment, toys or furniture.

- What is the extent of coverage for child-related incidents? Find out what will be covered in the event of an incident.

- Do any exclusions or limitations apply to outdoor play areas? Ask if the coverage applies to incidents in outdoor play areas and other locations outside your facility.

- Is additional coverage available for transportation services? Find out if your business insurance for daycare covers incidents that occur while children are transported in commercial vehicles. Typically, this will be covered by your commercial auto insurance, but it’s best to clarify which policy applies.

- Does the policy cover business closures and disruptions? Inquire about coverage options that may be relevant if the facility needs to shut down for natural disasters, health emergencies and other unforeseen events.

- What does the policy include? Some general liability policies include workers’ comp, property insurance and other types of coverage, potentially helping you save money.

- How does the claims process work? Find out what’s involved in filing a claim, including the necessary documentation and reporting process.

- Do fees or penalties apply if I cancel early or adjust my policy? This question will prevent surprise fees.

- Can I pay monthly? Are there financing options? Learn about payment options that will help with financial planning.

How to Compare Policies Effectively

Today, many online sites help you compare policies. Look for specific characteristics when determining which is best for your organization.

- Premiums: Premiums are the fees for your business insurance for daycare. However, you must look beyond the initial cost of the insurance to assess deductibles and the value you get for your money.

- Deductibles: Deductibles are the amount you will pay if a claim occurs. Policies with high deductibles tend to have low premiums and vice versa. Look for a policy that strikes the right balance.

- What’s included: Ensure the daycare insurance policy meets the legal requirements for childcare insurance for your state, loans, leases and contracts and find out what types of coverage the policy includes. Many general liability policies include commercial property insurance, which can be a cost-effective solution for daycare centers.

- Reputation: Research to determine if you are working with a reputable provider. Beyond online reviews, consider the provider’s financial rating, indicating financial stability. Companies like Markel, Philadelphia Insurance and Nationwide have dedicated childcare programs and can help you find a reputable provider.

- Policy limits: Small business insurance for preschools typically has an aggregate limit, the amount the policy will cover in a year and a per-occurrence limit, the amount the policy will cover for each claim. It may also have sub-limits that limit coverage for specific incidents. Small business insurance for preschools offers policy limits that are standard for various claims, but they should be considered when comparing plans.

- Fine print: Look at the fine print to determine if the daycare insurance policy offers seasonal coverage increases, special limits and restrictions and how it handles theft, damage and other issues. Ensure it provides a seamless process without surprise premium increases.

Legal Requirements and Compliance

Daycare facilities should purchase insurance with legal requirements for childcare insurance and compliance in mind. Here are some factors to be aware of.

State and Federal Regulations for Daycare Insurance

Federal law requires that states and territories enforce basic safety and health requirements for childcare programs. However, it does not require insurance — that’s up to the states.

State requirements for daycare liability insurance vary in terms of the types of insurance required and the amount of comprehensive childcare coverage. Here are some facts to consider:

- According to NAEYC, over 30 states require licensed daycare centers to carry liability insurance. About 14 states require all daycare centers to carry insurance, including family childcare homes.

- States also enforce specific coverage limits that range from $100,000 to $300,000. Although states have certain limits, choosing a policy tailored to your business is wise, even if it means exceeding the minimum.

- About 20 states do not require daycare centers to carry insurance. However, in many of those states, facilities without insurance must notify parents of their status, potentially damaging their potential to attract customers. Furthermore, centers without insurance are exposed to costly risks.

- Daycare centers are typically required to present their insurance certificates during license renewals. Those who don’t have insurance may be unable to renew their licenses.

Federal Considerations

Although the federal law does not enforce insurance policies for daycare centers, it has specific policies that may impact your insurance purchasing decisions. Here are some to consider.

- The Child Care and Development Block Grant (CCDBG) Act: This federal law helps enforce child safety by requiring facilities that receive funds to have liability insurance or to let parents know they don’t have insurance.

- Head Start/Early Start Programs: Administrators who open daycare centers or preschools under these programs may be required to carry liability insurance.

- Legal entities and subsidies: Daycare centers that want to qualify for subsidy programs, such as federal food programs, may require licenses and insurance.

Daycare administrators should know all federal and legal insurance requirements that may apply to their program. They should always have an insurance certificate they can present upon request.

How to Ensure Compliance with Childcare Licensing Requirements

Most states require you to have insurance before you can obtain your license. Other licensing requirements vary from state to state but may include:

- Attending an orientation

- Completing health and safety courses, including CPR, first aid and food safety

- Passing a pre-licensing inspection at your facility

- Filling out the required forms

- Paying an application fee

Consequences of Not Having Proper Insurance Coverage

Not having a license can result in these penalties and impact:

- Fines and revocation of your license: If authorities discover you are operating your facility without insurance, they can fine you, take your license and shut down your daycare center.

- Liability when incidents occur: Without insurance, you are liable for incidents at your facility. You will be responsible for paying medical bills, covering property damage and reimbursing other losses.

- Reduced enrollments: Parents will likely choose daycare centers with liability insurance over uninsured facilities.

Common Risks Faced by Daycare Centers

Running a daycare center involves common risks, making liability a necessity. Here are some to be aware of.

Injuries and Accidents

- Playground injuries: Young children lack balance and coordination. They may also be careless when playing with other children. As a result, over 213,000 children are taken to emergency rooms each year for playground incidents.

- Slips and falls: Slips and falls are common among children, parents and staff. They may occur due to spills or hazards like loose banisters, floor tiles and dim lighting.

Property Damage

- Natural disasters: Climate change has increased the risk of natural disasters, including earthquakes, hurricanes, flooding, storms and wildfires. Insurance can help you pay for related property damage and cover losses if you close your business for repairs.

- Vandalism: Sadly, daycare center vandalization happens. Insurance will cover damage that occurs to your building’s exterior or interior.

Allegations of Negligence

Young children need prudent supervision. When something goes wrong, it’s easy to say it happened because a staff member wasn’t paying close attention. Insurance will cover any damages related to these allegations.

Parent Lawsuits

Parents can sue daycare centers for any reason. Lawsuits commonly occur if parents feel a staff member was neglectful or even abusive. However, financial matters, like incorrect billing, can lead to legal issues, too. Daycare insurance covers legal and other related expenses.

Child-on-Child Bullying or Injuries

Daycare centers may be liable if a child injures another child if it can be proved that the staff was aware of the risk the defendant posed to other children and did nothing to address it.

Abuse and Molestation

A childcare facility may be at fault for abuse or molestation. They may be charged for negligent hiring and supervision.

Transportation Incidents

Auto incidents are a significant risk for daycare centers. Facilities may be targeted in lawsuits if children are injured in a commercial vehicle when taken to and from field trips or transported from the school to their homes.

Premises Liability

Premises liability may be necessary if unsafe conditions on the property injure children or visitors.

Illness Outbreaks

While rare, a daycare center can be sued if parents feel the staff contributed to spreading a dangerous illness by not implementing safety cautions or following health regulations.

How Vanco Supports Daycare Owners

Operating a daycare facility isn’t easy, but Vanco has your back. Here’s how we can help.

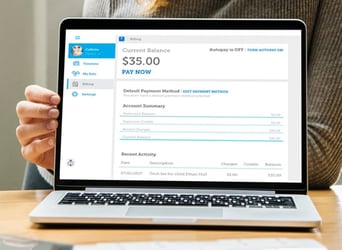

Streamlining Financial and Administrative Management

Our billing tools for childcare programs can streamline your financial management. You can use them to customize tuition schedules, automate billing and help families manage their payments. Paperless convenience means you don’t need to worry about losing documents and the advanced security gives you peace of mind.

Daycare centers can also benefit from our management platform. It automates billing and payments, online enrollment, tracks leads, manages compliance and provides financial reporting. Our experts will guide you through the process, ensuring a seamless experience.

Both products will help you cover liability costs. The financial management will ensure you budget accurately. When providers see you have systems to ensure compliance, they may reduce your premium.

Our products have received rave reviews from our customers: “I highly recommend it for a program looking for an all-in-one software. Perhaps the number one benefit is their customer support. It is seriously AMAZING!!” (Julie Schmitz, Show-Me Child Care, Jefferson City, MO)

FAQs

Is daycare liability insurance required by law?

Not every state mandates daycare center liability insurance. Regulations vary from state to state regarding whether and how much coverage is needed. However, daycare centers should consider insurance regardless of state law because it can help them attract clients and reduce expenses when incidents occur.

How does daycare insurance protect against lawsuits?

Daycare insurance protects you against lawsuits by covering financial losses due to claims. It can also cover your legal fees.

Growing Smart Kid’z Day Care in West Seattle is an example of a daycare center covered by insurance amid allegations of neglect. The case was closed in a $1.4 million settlement partially covered by the company’s insurance. Some of the money also came from the state.

What is the difference between general and professional liability insurance?

The main difference between general and professional liability is that general liability covers physical risks while professional liability covers more abstract risks. Here are some examples of what each provides.

General liability:

- Bodily injuries

- Medical payments

- Property damage

- Reputation harm that may occur if someone sues you for libel or slander

- Advertising errors that may lead to copyright infringement

Professional liability covers errors and omissions, for example, in a daycare setting:

- A child is injured due to inadequate supervision

- Poorly maintained play equipment causes injury

- Inadequate staffing leads to neglect

States require daycare centers to have some type of general liability insurance. Omissions and errors insurance is not always needed, but it is recommended.

Can home daycare providers get liability insurance?

Home daycare providers can and should get liability insurance. The type of insurance they need varies based on state requirements and may include these policies:

- Homeowners insurance: This covers losses and damages to property, assets and personal belongings, but may not extend to your business assets. If it doesn’t, you will need an additional policy.

- Liability Insurance: This broad insurance covers losses resulting from lawsuits and claims against you, including legal expenses, medical costs and other damages. There are various types of liability, such as:

- General liability

- Worker’s comp

- Commercial auto liability

- Abuse and molestation coverage

- Errors and omissions insurance

Research to determine which is suited to your professional needs.

How can I find an affordable daycare liability policy?

To find affordable daycare insurance, it may be best to look for a website offering a list of daycare liability insurance policies and providers to compare. Look out for factors like:

- Cost: Consider what’s included in the package. Ensure you get what you need without overpaying.

- Price: The premium and deductible are factors in childcare insurance costs. Typically, policies will have a high premium and low deductible or a low deductible and high premium. Decide which suits your business model and ensure fees are reasonable.

- Reputation: Work with a provider with a good industry reputation.

- Policy limits: Choose a plan covering incidents likely to occur at your facility.

- Fine print: Look at the fine print to learn about the provider’s claim-handling process and ensure you won’t get surprise wage increases.

You can also save money and access affordable daycare insurance by:

- Combining policies such as general liability and property damage

- Eliminating hazards — safer buildings get lower rates

- Seeking discounts — you may qualify for discounts by participating in safety programs or being a loyal customer

Final Thoughts on Daycare Liability Insurance

Insurance is a necessary investment for and a potential indicator of high-quality daycare providers. It provides comprehensive childcare coverage when incidents occur and is a legal requirement in most states. Insurance covers injuries, legal fees, property damage and reputational damage.

The best daycare insurance providers will help you understand what liability insurance covers and what is required. Check with local legislation to learn what coverage you need and compare policies to find the ideal plan. A strategic approach will protect your business, clients and company reputation.

Get 100+ Editable and Printable Templates for Almost Every Situation

We've prepared something special for you - 100+ user-friendly templates to make your important work a little easier. Because the work you do with children matters so very much, and you deserve tools you need.

Get the Full Collection with Just 4 Simple Steps: Assembly Required (0 Minutes)

Step 1: Click button

Step 2: Download 100+ ready-to-use daycare templates

Step 3: Implement immediately

Step 4: Experience efficient childcare management