Every year, 1.5 million people tithe to their churches in the United States, representing billions of dollars, and church financial reports are a critical part of this process. Churches are nonprofit organizations, so establishing a church budget and providing reports on their financial management to facilitate financial transparency with their members is an important function of their operations.

A holistic church financial report to congregation members can help churches maintain this financial transparency. This is why it’s so important to draft regular monthly or quarterly reports and an annual report at the end of every financial year.

Read on for a complete guide to everything you need to know about creating church financial reports.

Table of Contents

- Why Churches Need to Provide Financial Reports

- Free Church Financial Report Template

- Church Financial Reporting Requirements

- What Should Be in a Church Financial Report?

- What Should Be in a Church Annual Report?

- How Do You Write an Annual Report for a Church?

- Free Tools & Templates to Help with Church Finances

The Need to Provide Church Financial Statements

A church is a nonprofit organization and must keep accurate financial statements every year to maintain this status. These financial statements may not be needed for tax filings, but they are still incredibly important to describe the church’s finances. This is essential if the church ever wants to apply for a loan or prove financial viability.

In addition to potential tax and financial requirements, creating and maintaining accurate financial records helps churches maintain financial transparency.

Financial transparency is vital for churches, nonprofits and the government due to the source of their income. The bulk of a church’s income comes directly from the congregation, so it’s essential to create accurate church financial reports to show the congregation exactly where their money is going and to know the IRS rules for church donations. Financial transparency can help build a better relationship between church leadership, the congregation and the community at large. This can also include the church finance committee, which helps manage its finances.

Financial statements are also important to keep in case a church is ever audited by the IRS. Because churches have nonprofit tax status, an audit might be used to determine if they are actually running as nonprofits. Having all your church’s financial documents in order ensures you comply with all relevant legal regulations.

Making Financial Decisions

Financial statements let you know exactly how much money your church makes, how much money the church has, and where the money is. This is vital information that can help guide your operational decisions. Maintaining accurate financial statements can provide leaders with all the information they need to evaluate opportunities and plan outreach projects in the future.

At the end of the day, financial statements show you how much you can afford to spend. This comes in handy when planning what you’re going to spend in the next year. An annual report blends these elements together into one seamless document.

This one document will summarize what happened last year, how much money your church spent last year, what the church plans to do this year, and the budget for this year.

Monthly Church Financial Report to Congregation Members

A Lifeway Research report reveals that Americans lack confidence in churches as an institution. Confidence levels have been falling yearly, hitting an all-time low of just 31% in 2022. Financial reports can help restore that confidence.

These reports don’t have to be as detailed or lengthy as the annual report. However, the monthly report should include vital financial information to help your congregation stay informed.

Churches generate income from a number of different sources, with tithes often being the largest source. You can publish a monthly financial report for the congregation to let them know how much you collected in tithes for the previous month. This statement also can indicate how much money the church spent in the last month.

This simple church financial report lets everyone know how much money came into the church and how much was spent. If more money was spent, this tells the congregation that they need to help raise more funds for the church to cover its bills. In this way, the monthly church financial report to the congregation can encourage people to give more to their local churches.

Monthly reports work because transparency helps build community buy-in. The congregation and community feel like they are part of the church and share in the goals and aspirations of the church. In this way, they are also compelled to give more and do everything they can to make sure the church is successful.

At the end of the day, transparency makes the congregation feel like the success of the church is their own personal success.

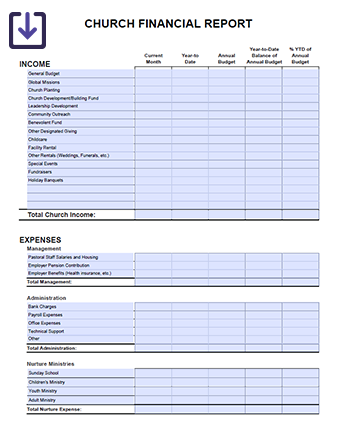

Free Church Financial Report Template

Building a church financial report can be challenging, especially when you do it from scratch. That’s why our team built a free editable template you can use to get started. The template is a fillable form that makes accounting easy. We also provide all the information you need to create your financial statement.

Free Church Financial Report Template!

Church Financial Reporting Requirements

As nonprofit organizations, churches are required to manage their finances throughout the year. While churches don’t need to submit tax returns, they should draft annual financial reports representing their entire organizations.

These reports can vary from organization to organization. However, there are a few requirements that must be in every report. Here’s a quick look at these essentials.

1. Balance Sheet

The balance sheet reports the church's assets, liability and shareholder equity within a specific time frame. For example, you can run a balance sheet for a month, year, several months or years. It provides an overview of the organization's financial health at a moment in time.

The balance sheet adheres to the following equation:

Assets= Liabilities + Shareholder Equity

The formula works because the church must pay its assets through donations.

Balance sheets help churches determine risk by revealing if the church has enough cash to meet current demands. It can also be used to secure loans. It allows church leaders to measure the church's profitability.

This video provides more insight on how to create a church balance sheet.

2. Income Statement

Also known as a profit and loss (P&L) statement, an income statement tracks the church's income sources and how much the organization made within a specific timeframe. It is typically broken down into various categories, such as:

- Online donations

- Cash donations

- Check donations

- Mission offerings

- Non-charitable payments

- Investment returns

- Rental income

- Fundraiser proceeds

It provides giving patterns, helping churches identify trends that can increase revenue and help them make financial decisions.

3. Expense Statement

The expense statement shows everything the church spends money on. Typical expenses include:

- Salary

- Insurance

- Marketing

- Office Supplies

- Building maintenance

- Utilities

- Travel

- Ministry-specific spending

Each expense must be categorized so churches can identify areas of overspending and underspending and adjust accordingly.

Expense and income statements are often combined to create a profit and loss (P&L) statement, showing the net assets within the given timeframe. It shows how well the church is performing. The statement can also be used to attract stakeholders and secure loans.

Watch this video to learn more about creating a church income statement.

4. Fund Balances

Fund balances reveal the church funds coming in for various purposes. For example, a church may set up a fund balance report to show how much revenue they collected for multiple projects, building initiatives and everyday operations.

A fund balance sheet is easy to create and record. Start by recording the first donation made toward a specific project. Continue adding funds as they come in.

Although these statements can be created manually, you can automate the process with modern tools like Vanco's Church Giving Dashboards. The dashboards report and track new and lapsed donors and recurring gifts. They allow you to understand giving trends at a glance.

Sign up to demo our system and gain access to real-time financial insights that support decision-making and transparency.

Church Financial Statements Summary

A church financial summary concisely overviews the church's economic income. It details income through a specific timeframe, such as tithes and offerings, expenses, and liabilities. It may be distributed to congregation members to help them understand how the church handles its resources.

You can simplify financial reporting with Vanco's dashboard. Schedule a no-risk demo to experience firsthand how easy financial reporting can be. Sign up today and get your church on track for enhanced decision-making and accountability.

What Should Be in a Church Annual Report?

An annual church financial report should go further than a monthly or quarterly financial report. The annual report is usually released a few months after the end of the financial year. This document should provide a complete summary of everything the church achieved during the last year along with plans for the upcoming year.

Financial reports simply outline the financial standing of the church. This information should be included in the annual report but should be adjusted to reflect the entire year. You can have the same forms and outline, but with annual figures instead of monthly numbers.

As mentioned above, including the previous year’s figures can help you compare how the church performed relative to past years. Most organizations include three years to provide a complete picture of the trajectory of the church’s finances.

Who Is the Annual Report For?

A church’s annual report is designed for the congregation and other stakeholders that interact with the church. This can include community leaders, local authorities and even other nonprofits in the area. This is why the annual report is simplified so everyone can understand it.

Summary of Operations

An annual report does not just focus on numbers, it also presents other statistics. These statistics paint a picture of the church and what the church does. This information is useful to help highlight what the church does with the resources it has.

These stats can vary from church to church depending on what each church does. Most churches like to track their outreach projects by showcasing how many meals they provided, how many people they baptized, or how many people dedicated their lives to God in the last year.

In this way, the report can clearly indicate what the church accomplished.

Summary of Income and Expenses

The annual report can have a detailed section for finances. This includes things like the balance sheet, income statement and expense statement for the year. However, it’s important to include financial summaries with your other stats.

This is because the stats are easier for stakeholders to read and understand compared to complicated financial documents. At the end of the day, the financial documents should be drafted according to general accounting principles. This means that they are accurate, but difficult for ordinary people to understand.

The highlighted stats that come with a short summary make it easier to get your message across. Most churches highlight important figures such as how much money was collected in tithes and how much was donated to the church privately. This can help you show exactly how much money came into the church that year.

The same can be done with the expenses for the year. Most churches take the top five expenses that year and highlight them under the expenses section. You can list the total expenses on top and the five biggest expenses broken down underneath.

This makes it incredibly easy to understand the church’s finances at a glance.

The Benefits of an Annual Report

Annual reports serve two purposes as follows:

- Support Financial Decision Making: A financial report provides churches with an overview of how much money they are making and how much they are spending. They can use that information to determine how to reduce spending and increase revenue. The data also helps them create budgets for future projects.

- Fosters Transparency: Not every church is frank about its financial activity. Some churches have been found guilty of embezzlement and misappropriation of funds. Others have internal control weaknesses that increase fraud risk. The Association of Fraud Examiners (ACFE) found that 6% of funds given by Christians globally are lost to fraud. Churches that use financial statements to ensure a reliable monetary system make donors feel confident donating money.

How Do You Write an Annual Report for a Church?

Annual reports can help improve financial transparency with your church and can be used to showcase the good your organization has done this year.

Annual reports can help improve financial transparency with your church and can be used to showcase the good your organization has done this year.

This is why you should always include detailed summaries of your operations and finances when drafting these reports. But how do you write an annual report for a church? Here’s a complete church finance guide!

Step 1: Consolidate Your Monthly Reports

Before you start writing your annual church financial report, it’s important to consolidate all previous financial information. This means looking through every financial report you created in the last year. If you have not created monthly financial reports, you can go through your church bank statements to get this information.

This information helps you write the initial summaries and draft the financial documents later. It’s important to collect and consolidate the information before you start drafting the annual report.

Step 2: Verify Your Numbers

Once you have all your financial information together, the next step is to verify the data. This ensures that no mistakes transfer from monthly reports to the annual report. The annual report will be distributed to your congregation and to stakeholders around the world, so it must be accurate.

A great way to verify your figures is to compare them to your bank statements for the year. Many organizations forget a few transactions like bank fees. While they are generally small amounts, they can add up to make a big difference at the end of the year.

Step 3: Summarize Your Operations

Operations can be summarized through reports that detail income and expenses. Key elements include:

- Total Revenue: All income from selling goods and services during the reporting period.

- Cost of Goods Sold: The costs associated with producing goods, such as raw materials.

- Operating Expenses: Expenses incurred through running operations, including salaries, rent, utility and marketing.

- Operating Income: Gross profit minus operating expenses.

- Non-Operating Income/Expenses: Income and expenses generated that were not directly related to core operations, such as interest and investment gains.

- Net Income: Income minus expenses and taxes representing final profitability.

Step 4: Highlight Your Achievements

The summary of your operations can cover everything you did this year; however, you should set a section aside to highlight your major achievements. These stats can be more direct because they should be linked to the goals you set at the beginning of the year.

Most churches highlight their outreach efforts along with spiritual stats such as attendance, baptisms and dedications. This section showcases the success that followed the church’s operations for the year. As with the organizational summary in Step 3, using stats and graphics can help make your points clearer to the reader.

Step 5: Summarize Your Church Finances

The next step is to use your verified information to summarize church finances. This section of the annual report introduces the actual financial documents. However, the summary is more important because most people can read and understand it quickly.

The financial summary should outline the core parts of the church financial report. This includes metrics such as the total amount of money that came into the church and the total expenses of the church. In addition to these figures, you can break down the sources of income and the most notable expenses.

Step 6: Create Annual Financial Statements

Once the summary is complete, you can consolidate all your previous monthly financial statements into an annual financial statement. These statements should follow accounting principles so they are accurate and standardized.

The balance sheet can also include figures from the previous financial year to show how the financial position of the church has evolved. This can either show that the church improved or deteriorated in the last year.

It’s important to provide accurate statements because both scenarios can benefit the church. If the church is doing well, the community can take pride in and continue to support a successful church. However, if the church is lacking funds, the community can rally around the church to help it become more successful.

The support of your church community is the key benefit of financial transparency.

Step 7: Create Annual Income Statements

The income statement is a financial statement focused on the church's profitability. It may be divided into categories such as:

- Tithes

- Offerings

- Grants

- Donations

- Rental income

- Money generated from events

- Special campaigns

The report should also state the church's losses throughout the year.

Step 8: Outline Your Expense Statement

An expense statement should also be included in your annual financial statements. It may consist of categories such as:

- Staff Expenses

- Facility expenses

- Ministry Expenses

- Administrative Expenses

- Fundraising Expenses

You may further categorize for increased accuracy. For example, church staff expenses may be divided into pastor salaries, administrative staff salaries, and benefits. Facility expenses may include building maintenance and repairs, utilities, and cleaning services.

You may include more detailed descriptions for each expense to enhance transparency. Consider comparing this year's expenses against last year's expenses to identify areas of adjustment.

Step 9: Update Your Fund Balances

To update your fund balances, you must:

- Identify designated funds such as general funds, mission funds, etc.

- Record all transactions for each fund, including donations, offerings and other income sources.

- Use fund accounting principles separating income and expenses for each fund.

- Calculate fund balances by subtracting total costs from income.

- Include fund balances in your financial statements.

Step 10: Write a Closing Summary

A closing summary provides highlights of the church's income and expenses. It allows church members to easily absorb pages of financial statements in a few lines of numbers or text to enhance transparency. This delivery method eliminates distrust, which often rears its head when members must obtain information from several digits and jargon.

A church may provide a closing summary using simple calculations or text explaining their goals and how close they came to achieving them based on profits and losses. A combination of text and numbers may be the most effective delivery method.

Are there guidelines for disclosing donor contributions?

A donor can donate to a church in return for goods and services. This expense is considered a quid pro quo contribution. Any amount beyond the market value of goods and services is considered a tax-deductible donation. Therefore, it is up to the church to disclose the market value of the good.

For example, if a donor purchases a book from a church for $20 but gives the church $50, the additional $30 is considered a tax-deductible donation. The church must disclose the fair market price of the book ($20), ensuring the donor knows how much they are donating and can file taxes accordingly.

The disclosure statement must be a written document visible to the donor. For example, if the disclosure is in small print on a large document, it may not be acceptable.

Churches may not be required to issue a disclosure statement if:

- The goods and services are of insubstantial value

- The donor only receives an intangible religious benefit, such as admission to a spiritual benefit or a minimus tangible benefit, like wine used in a religious ceremony.

This video serves as a sample church financial statements delivery. It shows how the New Day Community Church delivered its year-end financial report for 2019.

Are there legal requirements for church financial statements?

Churches aren’t required to provide giving statements unless there is an exchange of goods or services after receiving a donation of $75 or more. Outside of that scenario, there isn’t a penalty for not providing a contribution statement in the United States.

However, it’s still recommended that churches do provide these giving statements for several reasons. First, the statement enables donors to file their contribution as a write-off on their own taxes and they can’t legally file a donation with the IRS without written proof of what, and how much, they gave. Donors bear responsibility for obtaining a written acknowledgment from a charity for any single contribution of $250 or more before they can claim a charitable contribution on their federal income tax returns.

These statements can also be useful for a church in the event of an IRS audit, since they will have to disclose contribution and accounting info to the state. So while there isn’t a legal requirement to provide financial statements for many donations, doing so is largely beneficial for both the church and the donor.

How can a church ensure transparency in financial reporting?

Transparency matters for church finances, as it’s important to be up front with all stakeholders about the financial contributions a church receives, how it utilizes those funds and its overall stewardship of its resources.

Understanding and complying with all local, state and federal tax laws is a key part of this equation. In order to ensure transparency in your church’s financial reporting, be certain to keep accurate records of all donations and contributions it receives. Maintain those records not just through the current tax year, but beyond in case you need to refer back to them.

Having a qualified financial professional as part of your church’s financial team also helps with transparency. Whether you have a member of your congregation who works in finance or a certified professional you hire to help with taxes, their knowledge is a huge asset to your church alongside your internal financial team, treasurer or elders.

In many states, churches are also required to file an annual financial report with their secretary of state’s office.

Free Tools & Templates to Help with Church Finances

Could your church use powerful tools to help manage and maintain its finances? Here are three key resources included within our free kit to help you and your team:

- Church finance committee agenda template

- Church budget planning template

- Church finance statement template

Access all the free resources now!