A sound, realistic and well-made church budget and effective ongoing church budgeting are vital parts of planning for the future.

In simple terms, budgets are a consolidation of an organization’s income and expenses in a single document. A budget is usually created well in advance and is a pivotal part of the planning process, which also includes generating church financial reports to keep members up to date.

Because churches are nonprofit organizations and don’t generate as much income as businesses, every cent counts.

But church budgeting and financial planning can be complex. This guide is designed to explain the purpose and value of a church budget, help you create a budget specifically for your church and ensure that your church finances are properly run and maintained.

Thinking about creating a holistic budget for your church? Read on for more information on how to create a church budget and a few tips to boost your revenue.

Table of Contents

- Why Church Budgeting Is Important

- What’s the Purpose of a Church Budget?

- Different Types of Church Budgets

- Questions to Ask Before Creating a Budget

- What Should You Include in Your Church Budget?

- How to Maximize Your Net Revenue

- How to Create a Church Budget

- Essential Tips for a Realistic Church Budget

- Church Budget Template

- Free Tools and Templates to Help with Church Finances

- The Importance of Regular Budget Reviews for Church Expenses

- Steps for Effective Budget Reviews for Church Expenses

- Leveraging Technology for Budget Management

- Strategies for Dealing with Unexpected Financial Shortfalls

- Setting Financial Priorities

- Frequently Asked Questions (FAQs)

Download the Free Church Budget Template!

Download the Free Church Budget Template!

Why Church Budgeting Is Important

Whether you’re planning for your business, family or church, budgeting is an important part of the process. Everything costs money, so it’s vital to ensure you have enough money to cover everything you want to do that year.

Whether you’re planning for your business, family or church, budgeting is an important part of the process. Everything costs money, so it’s vital to ensure you have enough money to cover everything you want to do that year.

Churches operate in the same way as businesses and nonprofit organizations — they need to generate revenue to keep running. Having a solid financial plan helps churches ensure that they have enough money to keep the lights on throughout the year and well into the future.

Budgeting is not just financial planning. It can also help you plan organizational activities. This is because raising funds is an essential part of generating church income. Whether you want to raise money for church expenses or fund community projects, all related activities should be budgeted well in advance.

Just like a growing family, a budget should account for a growing church. This may mean that you need to set aside money for maintenance, repairs and expansion. Your church budget should include all your expenses for the year and keep an eye on future projects.

Financial management is incredibly important in churches. This has never been more important due to the growing scrutiny around how money is spent. So, what is the purpose of a well-made church budget?

What’s the Purpose of a Church Budget?

The church budget can act as a guide for church leadership, including pastors, staff and your church finance committee. This is because the amount of money you bring in can help you run programs and projects for the community. Whether your ministry has plans to build a financial reserve or expand the church building, you should include these goals in a holistic budget.

The church budgeting process takes these ambitions and goals and lists them as realistic targets. This process includes doing research about the project so you can estimate how much money you will need. This number can then be included in the budget for the year.

If a project requires more money, your budget can adapt to that. This may mean the church puts away a certain amount of money every month to fund that project in the future.

Budgeting can be seen as a form of organizational and financial planning. This is because the estimated cost for a project can influence your organizational decisions as a church. If the project will cost more than the church can afford, you must plan additional fundraising efforts.

On the other hand, if the estimated costs are lower, the church will have more money to designate elsewhere. This could mean funding more programs, making other upgrades or even expanding the project itself.

In a financial sense, budgeting helps keep track of church finances. This helps with transparency as you can share the good you do with tithes, offerings and donations. This is not to brag or show off but rather to encourage people to continue to invest in the community through the church.

Before you begin the church budgeting process, it’s important to consider what type of budget will work best for your church.

Different Types of Church Budgets

Budgeting for a church is similar to budgeting for a business. While church budgets include a detailed list of expenses, they also incorporate church income as a variable. This is because the income a church receives can vary from month to month just like a business.

Budgeting for a church is similar to budgeting for a business. While church budgets include a detailed list of expenses, they also incorporate church income as a variable. This is because the income a church receives can vary from month to month just like a business.

There is more than one kind of budget you can use for your church. The budgets are similar but have slightly different approaches. Here’s a quick overview of the three different types of budgets you can make for your church.

1. Zero-Based Budgeting

In simple terms, a zero-based budget takes each period as an individual budget that must be settled within that period. This means that all expenses must be paid with the income generated during that period. While some companies choose to do this every year, others will zero their budgets every three or five years.

If you implement this kind of budget on an annual basis, it means that you must create the budget from scratch to meet the goals that year. This kind of budget can help lower costs and keep track of every expense. This is because each expense is added annually and not automatically taken with an increase from last year’s budget.

2. Program Budgeting

Program budgeting is a decentralized budget that focuses on individual programs at your church. This budget takes both the income and expenses of each program itself into account. This way, you can quickly see if the program can raise enough funds to accomplish everything it plans to.

This kind of budget is perfect for churches that host community projects because you can easily see if a project is financially viable on its own. While essential projects can still draw extra funds from the church, having a financially independent project is the best-case scenario.

Each program has its own list of income and expenses, with a net income or loss listed at the end. A program budget guides you and lets you know if you need to raise more money or if you have enough to scale up the project itself.

3. Line-Item Budgeting

Line-item budgeting is perfect for projects and programs that your church runs. This kind of budget highlights the estimated cost alongside last year’s project cost. This way, line-item budgets make it incredibly easy to analyze financial data.

This kind of budget can also work for an entire church. A line-item budget lists all the expenses based on the budget from last year. The new budget then expands to the new year, allowing you to add or subtract from last year’s budget.

This is perfect for churches that already have great budgets and don’t plan on making too many changes each year. All you have to do is add another column each year and you’re all set.

Now ask yourself some questions about your church’s financial condition, sources of revenue and future plans.

Questions to Ask Before Creating a Budget

Church budgets can be created for different purposes. Whether you want to create a budget for a specific project or for the entire church, it’s important to be well-informed from the start. Ask yourself a few questions to guide your budget.

Church budgets can be created for different purposes. Whether you want to create a budget for a specific project or for the entire church, it’s important to be well-informed from the start. Ask yourself a few questions to guide your budget.

1. Does Your Church Struggle with Finances?

Budgeting is essential to make sure that you have enough income to cover your expenses. Planning your finances in advance is vital because you want to have enough money during certain times of the year. Budgeting in advance helps.

If your church struggles to bring in enough income, this is important to keep in mind when drafting your budget. Your budget should take this into consideration by limiting or controlling expenses. This way, you can ensure that you have enough money for the essential aspects of keeping the church running.

This can also guide your budgeting decisions when it comes to funding additional projects. If your church plans to do more outreach but does not have enough funds, you can think about hosting more fundraisers. In this way, the budget can show you what you can afford and what you’ll need outside fundraising to help with.

2. Where Does Your Church Generate Most Revenue?

As a holistic budget, a church budget should outline both expected income and expenditures for the year. This is why it’s essential to find out exactly how much and where your church generates revenue. This can help you outline it in the budget and highlight issues you may have throughout the year.

If your church generates most of its revenue from tithes, you should be prepared to generate less income during certain months of the year when attendance is lower. However, if some funds come from grants and donations at the beginning of the year, you can treat these funds differently. In most cases, churches treat this as guaranteed income to cover essential bills.

On the other hand, you can spend variable income from tithes and fundraising efforts on outreach projects. The projects can scale up depending on how much money is available.

3. Do You Have Plans for the Future?

Church budgeting is a form of planning. This is why it’s important to understand your short- and long-term church goals. These plans should be integrated into the budget early to ensure the funds are there when they’re needed.

Whether your church plans to launch a massive project next year or wants to extend the building itself, setting funds aside early can help. Some churches choose to share their long-term ambitions with the congregation and open separate accounts for those projects. This way, people can donate directly to these causes, while the church also puts money aside every month.

This can help make massive projects more realistic. Sharing your plans with the community early also encourages them to buy in to the idea. This way, the community can rally around the project and contribute to making it a reality.

You’ve answered some basic questions about your church and your budget. How do you put it together?

What Should You Include in Your Church Budget?

As mentioned above, a well-made church budget should be a simple, clear summary of the church’s income and expenses. Modern churches manage a wide range of income sources. Churches bring in money from donations, grants, tithes and even through some commercial avenues.

As mentioned above, a well-made church budget should be a simple, clear summary of the church’s income and expenses. Modern churches manage a wide range of income sources. Churches bring in money from donations, grants, tithes and even through some commercial avenues.

Churches can generate income by selling clothing, accessories, books, content and other kinds of merchandise. While this added income is great, it also comes with expenses.

Running a modern-day church includes more than just keeping the building running. Modern churches also need to factor in production costs, marketing and salaries for church employees. This is what makes church budgets just as complicated as traditional business budgets.

Sources of Income

The first part of your church budget should be dedicated to summarizing all sources of income. These income sources can range from interest income to individual donations and grants. Here’s a quick look at the different income sources to include in a church budget.

1. Donations

After tithes, donations are often the second most common source of income for churches. Whether these donations are made for specific reasons or for the church in general, these gifts are substantial.

2. Grants

Churches can often access special grants when managing community outreach projects. These projects can range in size, but grants are a great way to ensure you have the funds you need to help the community.

3. Tithes

Tithes are incredibly important to help churches continue doing their good work. Tithes are the most common source of income for churches, with a few modern tools that make it even easier for people to give. These innovative payment methods include added features to help track payments, making budgeting that much easier.

4. Fundraising Events

The best way to raise funds for a specific program is to host a fundraising event. These events can range in size but are an effective way to engage with the community and stakeholders before launching a new program or project.

5. Venue Hires

Most churches rent out their main halls for events. While the most common event may be weddings, modern church halls can also host corporate events and even music concerts. Renting out your hall is a great way to bring in revenue without doing much work.

6. Ministry Products

Ministry products are a great way to generate revenue for your church. From posting content online to selling branded merchandise, churches can bring in quite a bit of money this way. Selling ministry products can diversify your church’s income, allowing you to operate with less risk throughout the year.

7. Investment Income

When it comes to putting money aside for the future, it’s important to place the funds in interest-bearing accounts. This helps the funds grow as you wait to use them.

There are also other investments you can make as a church, such as investing in a coffee shop or a bookstore in or near your church. These businesses can help generate income for the church.

List of Expenses

Keeping a modern church up and running consists of a wide range of expenses. While some of these expenses are linked directly to the building, some are digital expenses such as software, marketing and even continuing education. Here’s an overview of the most popular expenses to include in your church budget template.

1. Administration and Facilities

There are a few major administration costs to consider when creating your church budget: insurance, office supplies, electricity, heating/cooling and property tax (if you own the building). These costs can vary depending on the size of your church.

2. Employees

Regardless of the size of your church, there are always employee costs to keep in mind. Most churches hire a few full-time employees to keep the church running, including someone at the front desk, a financial person, and senior pastoral staff.

3. Equipment

Maintaining and upgrading your church is essential. This includes fixing any musical equipment or computers that may need repairs. While this is technically an expense, many consider it an investment in your church.

4. Outreach

Outreach costs can vary from church to church. This is because some churches may need to prioritize their own expenses until they’re in the financial position to help the community. Whether you’re planning to run a soup kitchen or sponsor a food drive, do not forget to include outreach and the administrative costs that go with it.

5. Expansion

When it comes to your church’s plans for the future, budgeting is the first place to start. Setting money aside for future projects can go a long way to making sure your plans become a reality. Even if you set aside a fraction of your income every month, every dollar counts.

6. Debts and Finances

If your church has debts, they should always take priority in your budget. This is because these loans tend to come with interest and penalties that can add up quickly. Covering your debts first is essential.

7. Marketing

Modern churches have a few digital expenses to include in their budget. Marketing is one of these expenses and is a great investment to help bring more people to your church. This can also be a great tool to help raise funds for your specific projects.

Whether you decide to invest in individual ads or to work with a marketing agency, this cost can scale depending on your goals.

8. Travel Expenses

Travel expenses can range from car rentals to airline tickets if your pastoral staff ever needs to travel to another city. Hiring cars and buses is also common to transport people when you host events in another venue or town.

9. Training and Continuing Education

Training and education are great investments to make in your staff. From an online course to sponsoring Bible school for future pastors, these costs should be included in your annual church budget.

10. Financial Reserves

It’s important to budget for the future. If you have projects planned for the future, putting money aside every month can come in handy. If you want to save for a variety of different projects, consider opening a different bank account for each one.

This can help you manage your church’s finances more efficiently. You can also share the details for each unique bank account to collect donations. This way, people who donate can rest assured that their money is going directly to that cause.

Now that you have identified your needs, how can you find the money to meet them?

How to Maximize Your Net Revenue

Generating income is important to enable churches to continue the good work they do. There are a few things you can do to maximize your revenue. Here’s a quick look at some helpful tips.

Generating income is important to enable churches to continue the good work they do. There are a few things you can do to maximize your revenue. Here’s a quick look at some helpful tips.

1. Make Donating Simple

Whether your church relies primarily on tithes or individual donations, making the donation process easier can boost your revenue. While many churches still use cash, offering digital payment options can help streamline the process.

2. Offer Subscriptions

Digital payments make it easy to encourage subscriptions. Subscriptions can help secure a steady stream of income for your church as tithes and donations automatically come into your church’s bank account. This helps remove some of the risks associated with seasonal attendance.

Creating a church app is another great way to generate additional revenue from your church members. These apps increase engagement within your church community and offer a unique way to encourage members to give.

3. Host Fundraising Events

Fundraising events are a great way to raise money for a specific cause. These events offer you the opportunity to meet and engage with the community and various stakeholders. They make your fundraising attempts more than just a poster or a post on social media that people can simply walk or scroll past.

4. Invest in Community Partnerships

Partnering with the community is an essential part of running a successful program. Working with other businesses and community members can help open the door to more funding or more partners to share expenses with. Either way, you can expand your mission without having your budget hold you back.

5. Prioritize Financial Transparency

When it comes to working with the community, transparency is key. Being transparent can help you engage with the community, allowing people to trust you and the projects you’re working on. This can also help build community buy-in to raise more funds.

Now you’re ready to create your budget. Here are some essential steps to do that.

How to Make a Church Budget

Creating a church budget consolidates all your income and expenses in one document. While these budgets can be rough guidelines, they can also be incredibly detailed. Here’s a quick step-by-step guide on how to create a simple budget for your church.

Creating a church budget consolidates all your income and expenses in one document. While these budgets can be rough guidelines, they can also be incredibly detailed. Here’s a quick step-by-step guide on how to create a simple budget for your church.

Step 1: Set Realistic Goals

The first step in creating a church budget is to outline your goals. Church goals can be both financial and operational, to help guide the plan for the year. Your budget plays a major role in turning your ambitions into actionable financial statements and goals and determining your expenses for the year.

Step 2: Summarize Your Income

The next step in the church budgeting process is to list your income sources for the year. This includes your estimated income from tithes, offerings and donations. However, this can also include the estimated revenue from any fundraising events you want to have that year.

Once you have your estimated income for the year, you can use it to determine the projects and programs you can afford to run. If your income does not cover everything you want to do, you can plan more fundraising events.

Step 3: Consolidate Expenses

After you list your estimated income, summarize your expenses. These expenses should cover running the church itself, paying staff, funding projects and even putting money aside for the future.

Step 4: Create Financial Reserves

While churches are nonprofit organizations, you should still put money aside for a rainy day. Putting money aside in advance can help you plan for the future, and it will come in handy during months when you don’t generate as much revenue. In this way, your financial reserve can help keep your church running without a hitch.

Step 5: Don’t Forget Variable Costs

Churches generate income in similar ways to businesses, and like a business, a church’s income can vary from month to month. This is an important concept to include in your budget and you should design your budget with flexibility in mind.

While costs like your mortgage payment are fixed, project and outreach expenses have some flexibility. This means that you can scale projects up or down depending on how much income actually comes into the church.

After you complete the basic church budgeting steps, how can you make the budget real for your church?

Essential Tips for a Realistic Church Budget

![]() Creating a church budget is the simplest way to plan and manage your finances. With the right tips and guidance, this budget can be incredibly accurate and guide church operations. Here are a few essential tips that will help you create a budget for your church.

Creating a church budget is the simplest way to plan and manage your finances. With the right tips and guidance, this budget can be incredibly accurate and guide church operations. Here are a few essential tips that will help you create a budget for your church.

1. Budget Monthly

Budgeting for the year includes quite a bit of estimation. While these estimates can be accurate, budgeting monthly is a great way to keep your budget realistic and achievable.

Monthly budgets can help you keep a close eye on every cent that leaves the church and how much income you’re generating at the same time. This means that you can quickly adjust the budget if you have not brought in as much money as you expected to.

2. Use Historical Data

As mentioned above, accuracy is the most important metric when drafting your budget. While estimates are never certain, using historical data is a great place to start. This is because the best indication of how much it will cost to keep your church running next year is to see how much it cost last year.

This is a notable benefit of using a line-item budget for your church. Even if you don’t want to use this kind of church budget, keeping one handy can help you start the following year’s budget.

3. Account for Maintenance

While many people include upgrades as part of the church budgeting process, they often overlook maintenance. Whether you rent or own the building, maintenance is an important expense to include in your budget. From servicing your HVAC system to inspecting your roof and plumbing, these maintenance costs can surprise you at the end of the year.

4. Consider Seasonal Attendance

If your church generates most of its revenue from tithes and offerings, it’s important to consider the effect attendance can have on your revenue. In most churches, attendance numbers fluctuate throughout the year depending on the weather and the time of year. Budgeting accordingly will ensure you have enough money to cover your costs throughout the year.

5. Don’t Be Scared of Budget Cuts

Because budgets are part of the planning process, they are usually compiled at the beginning of the year. They are also generated using estimated income and expenses for the year. While you should always take steps to keep your budget accurate, you should not be scared to modify the budget throughout the year.

If you do not bring in as much income as you estimated, budget cuts can help balance the books. This is another major benefit of breaking your budget into monthly budgets. Managing your budget monthly can help you adjust for the next month to keep your church finances under control.

There is a lot of analysis and detail involved in creating a church budget. Here’s a template to help you make your budget a reality.

Church Budget Template

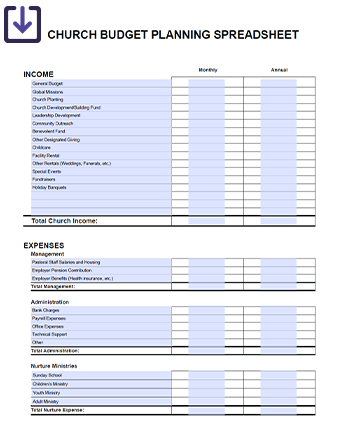

The church budget example template link below provides a space where you can organize church budgetary allocations while calculating all expenses by month or by year. Additionally, there are sections to compare the budget items from the previous year, the current year and the next operational year as well.

This church budget template provides a form of organization, spending tracking and recording goals for different areas and budget items of the church including staffing, general church operations, administration and facility expenses. From keeping track of ministry activities, utilities and event coordination, church groups of any size can customize how they form their financial plans.

Being financially organized enables congregations to get more out of their funding, save money and allocate spending properly. This is an essential tool for forming better financial management tactics, holding the right people responsible for different budget items and providing an easier way to track where church funds are actually going. This is also beneficial for improving your marketing tactics, not just when it's time to create your annual church financial report.

This is also helpful for church organizations that want to expand their resources and make plans for the future simpler. Overall, if a church wants to better visualize its financial situation, this worksheet can help with that. The main benefits are complete organization and spending projections.

Finally, this template can help church leaders modify their spending as needed to either stay on budget or on track with milestones. Download the template and get started today.

Download the Free Church Budget Template!

The Importance of Regular Budget Reviews for Church Expenses

Regular budget reviews are essential for maintaining financial health and ensuring that your church stays on course with its financial goals. Here are a few reasons budget reviews are vital

Identify Financial Issues Early

Regular reviews allow your church to identify discrepancies or issues early, preventing small problems from becoming major financial crises. This proactive approach ensures that your church can address issues before they impact church operations — and operational costs.

Ensure Accountability

Budget reviews also promote accountability. By regularly reviewing the budget, church leadership can ensure that all funds are used appropriately, and that spending aligns with the church’s mission.

Optimize Resource Allocation

Through regular budget reviews of all budget items, churches can optimize their resource allocation. This means directing funds to the most critical areas, such as outreach programs, staff salaries or building maintenance.

Adapt to Changes

The financial landscape can change throughout the year. Regular budget item reviews allow the church to adapt to these changes, whether they involve unexpected expenses, changes in income or shifts in church priorities.

Plan for the Future

Finally, regular budget reviews contribute to long-term financial planning. By regularly assessing the church’s financial situation, leadership can make informed decisions about future projects, growth costs and opportunities and financial goals.

Steps for Effective Budget Reviews for Church Expenses

To ensure effective budget reviews, follow these steps.

Step 1: Schedule Monthly or Quarterly Reviews

Set a regular schedule for budget reviews, either monthly or quarterly. This ensures that the budget is monitored consistently, and any issues are addressed promptly.

One way to do this is to conduct a regular church audit. If you’re looking for detailed steps on how to do that, check out this detailed guide from the United Methodist church, which explains it thoroughly.

Step 2: Compare Actual Spending Against the Budget

During each review, compare actual spending to the budgeted amounts. Identify any variances and analyze the reasons behind them.

Step 3: Discuss Findings with the Finance Committee

Share budget review findings with the finance committee. Depending on the church's leadership structure model, other individuals or teams might also be involved in this review process. This team can provide insights and make recommendations for adjustments based on your church finance committee guidelines.

Step 4: Adjust the Budget as Needed

If you find significant variances, adjust the budget to reflect new financial realities. This might involve reallocating funds, cutting expenses or increasing fundraising efforts.

Leveraging Technology for Budget Management

In today’s digital age, technology can greatly simplify church budget management. Various tools and software can help track income, manage expenses and forecast financial needs.

Financial Management and Budgeting Software

Financial management software like Concordia, Icon, ACS or PowerChurch can automate many aspects of financial management, making it easier to create, track and adjust your budget. Tools like these have been real time savers for church staff and volunteers. Here’s a closer look at the two tools specifically for churches.

ACS

ACS church accounting software is a double-entry accounting system that follows nonprofit accounting standards and uses either a cash or accrual basis. Users first create a chart of accounts, which then interfaces with its other financial modules and can also be set up to interact with ACS Contributions and HeadMaster. Features include:

- Tracking budgets and spending by fund, department, committee and project

- System-wide data integration

- Built-in ACH option

- Microsoft Excel interface

- Reliable, centralized asset inventory and management system

PowerChurch

PowerChurch’s accounting system is designed specifically for churches. It includes advanced features for churches that work with accounting professionals or have them on staff, but its basic setup is built in a way that allows those without this next-level accounting help to audit and maintain their books without spending a significant number of hours on the process. Its features include:

- General ledger that helps track restricted gifts based on FASB 117 guidelines, manage and balance all of your funds, generate month-end reporting and track budgets based on the status of your current and prior years' performance

- On-time bill payment assurance that protects your church's credit status by keeping accurate records of all invoices and payments due and storing each vendor's payment history so you can record handwritten checks or print computer checks

- Accounts receivable capabilities to manage recurring payments such as lease, mortgage, insurance and utility bills

- Streamlined payroll tools to fulfill requirements such as Social Security exemptions, pretax deductions and calculating withholding amounts automatically

Online Donation Platforms

Online donation platforms streamline the income process, making it easier to track tithes and donations. These platforms often come with built-in reporting tools that can integrate directly into your budgeting software. If you’re looking for an in-depth review of these platforms, check out this Top 15 Church Giving Software Guide. Or, for a closer look at how a church-specific donation platform works, check out the video below.

Strategies for Dealing with Unexpected Financial Shortfalls

If your church encounters a financial shortfall, the first step is to identify the cause. It may be due to lower-than-expected income, unexpected expenses or a combination of both. Once you identify the cause, consider these strategies:

- Reallocate funds: Shift funds from less critical areas to cover the shortfall.

- Increase fundraising efforts: Host additional fundraising events or campaigns to raise the needed funds. If you’re looking for a solid fundraising event, we came up with a comprehensive list of church fundraising events used by the 25,000 churches we’ve worked with.

- Use the emergency fund: If your church has an emergency fund, this is the time to use it.

Building Financial Resilience

Building financial resilience involves planning for the unexpected and creating a buffer against financial instability. Here are some tips:

- Diversify income streams: Don’t rely solely on tithes and offerings. Explore other revenue sources such as renting out church facilities or selling ministry products. Here’s a complete list of church fund sources to explore.

- Encourage recurring donations: In Vanco’s study of 25,000 churches, we found that congregants who set up recurring gifts donated more than twice as much as those who did not. By making giving automatic, you can make your budget more predictable.

- Maintain a healthy reserve: Keep a financial reserve that can cover several months of operating expenses. This ensures that the church can continue to operate even during lean times.

Setting Financial Priorities

Setting financial priorities is essential for ensuring that your church’s budget aligns with its goals and mission.

Aligning Spending with Church Goals and Mission

To effectively align your budget with your church’s mission, start by identifying your top priorities. These might include outreach programs, staff development or building maintenance. Ensure that your budget reflects these priorities by allocating sufficient funds to each area.

A survey by the Unstuck Group found that 52 percent of church budgets go to staffing expenditures such as salaries, benefits and payroll taxes. Churches included in the study spent an additional 17 percent on buildings and facility expenses. Knowing that more than half of your budget is likely going toward staffing expenses, it’s important to approach the remainder of your budget with this reality in mind.

Guidance on Prioritizing Expenditures

When prioritizing expenditures, consider both short-term needs and long-term goals. For example, while it’s important to cover operational costs, setting aside church growth funds for future projects, other growth costs and operational costs is also crucial. Make sure that your budget balances these competing demands.

Frequently Asked Questions (FAQs)

To help guide your church budgeting process, here are some common questions and answers.

What Is the Best Budgeting Method for a Church?

The best budgeting method depends on your church’s size and needs. Common methods include:

- Zero-based budgeting: This method requires starting from scratch each year, justifying every expense. It’s ideal for churches looking to control costs.

- Program budgeting: Focuses on individual programs and their financial viability. It’s perfect for churches with multiple outreach initiatives. It’s been used in government programs for decades and is still common in municipalities across the country.

- Line-item budgeting: This method builds on the previous year’s budget, making it easy to track changes and trends over time.

How Often Should a Church Review Its Budget?

It’s recommended that churches review their budgets at least quarterly. However, monthly reviews are ideal for closely monitoring finances and making timely adjustments.

What Are Common Mistakes to Avoid in Church Budgeting?

Common mistakes include:

- Underestimating expenses: Failing to account for all costs can lead to budget shortfalls.

- Overestimating income: Being overly optimistic about income projections can result in financial strain.

- Not regularly reviewing the budget: Without regular reviews, it’s easy to miss financial issues that could become serious problems.

How Can a Church Increase Its Income?

Consider these strategies:

- Enhance online donations: Make it easy for members to give online through a user-friendly platform.

- Be aware of the latest giving trends: Giving to churches has changed a lot in the past two decades. Here’s a resource that gives a complete rundown of the top 45 stats you need to know.

- Host fundraising events: Plan events that engage the community and raise funds for specific causes.

- Explore new revenue streams: Consider renting out church facilities or selling ministry products.

What Expenses Should Be Included in a Church Budget?

A comprehensive church budget should include:

- Staff salaries: Including pastors, administrative staff and other employees

- Operational costs: Such as utilities, maintenance and office supplies

- Outreach programs: Funding for community programs, mission trips and other outreach activities

- Building maintenance: Regular maintenance and repairs, plus funds for future renovations

- Financial reserves: Funds for emergencies and future projects

How Can Churches Handle Unexpected Expenses in a Church Budget?

To handle unexpected expenses:

- Use contingency funds: If you have a contingency fund, allocate it to cover the unexpected costs.

- Reallocate budget items: Shift funds from less critical areas to address immediate needs.

- Plan for the future: After addressing the current issue, revise your budget to better prepare for future unexpected expenses.

Free Tools and Templates to Help with Church Finances

![]() Could your church use powerful tools to help manage and maintain its finances? Here are three key resources included within our free kit to help you and your team:

Could your church use powerful tools to help manage and maintain its finances? Here are three key resources included within our free kit to help you and your team:

- Church finance committee agenda template

- Church budget planning template

- Church finance statement template

Access all the free resources now!